Over recent decades, the private equity market has become highly sophisticated, and competitive, where each firm seeks to maximise investment returns for its investors through different business models and varying competitive advantages. Each firm also has its own unique approach – no two private equity managers create value and deliver returns in quite the same way.

But there is one characteristic they share: it is the long-term, “committed” nature of the private equity model and it is what enables private equity, as an asset class, to consistently outperform.

Private equity investors think and invest in decades, not quarters. On the one hand, this means that investors in private equity funds are “committed” for that same period and cannot trade or redeem their investments overnight. On the other, though, it enables private equity managers to generate and consistently deliver superior returns for those investors for several reasons:

- Committed capital allows private equity managers to apply a flexible, long-term mindset.

Private equity managers are not choosing from a finite pool of listed companies, often focused on their next set of quarterly earnings. Instead, they have an almost unlimited (and growing) universe of private companies to select from. Long-term, committed capital means they can be very careful and diligent in their origination processes, and then invest to optimise for long-term growth, and then choose the right time to buy and sell.

- Committed capital gives portfolio executives the time, space and toolbox to create lasting value.

A true partnership approach to private equity investing – one that we stand by – means empowering the management teams running the companies you back to deliver on long-term goals. Committed capital facilitates this; not only does it mean they can focus on making the right long-term investment decisions (even if it means short-term pain), but it also allows private equity “value creation teams” the time to deliver on their plans, ultimately to help create strategic, must-have companies. Patient capital allows everyone to build not just bigger, but also better businesses.

- Committed capital promotes specialisation, which allows private equity manages to build differentiated insights within specific industries.

Your first investment is very rarely your best. It can take decades of learning, humility and so-called “pattern recognition” until a private equity manager can understand a topic or industry better than its peers. Committed, long-term capital promotes this kind of specialisation and enables firms to accumulate deep insights over time that will set it apart when it comes to finding new companies to back and helping those companies to grow at scale.

The committed nature of investing in private equity funds is often framed as a disadvantage of the asset class – on the face of it nobody loves “illiquidity”. But while all sorts of commitments can be inconvenient from time to time, they can often prove worthwhile, not in spite of the commitment, but because of it. The commitment itself is the source of the value. It is the same with private equity investing.

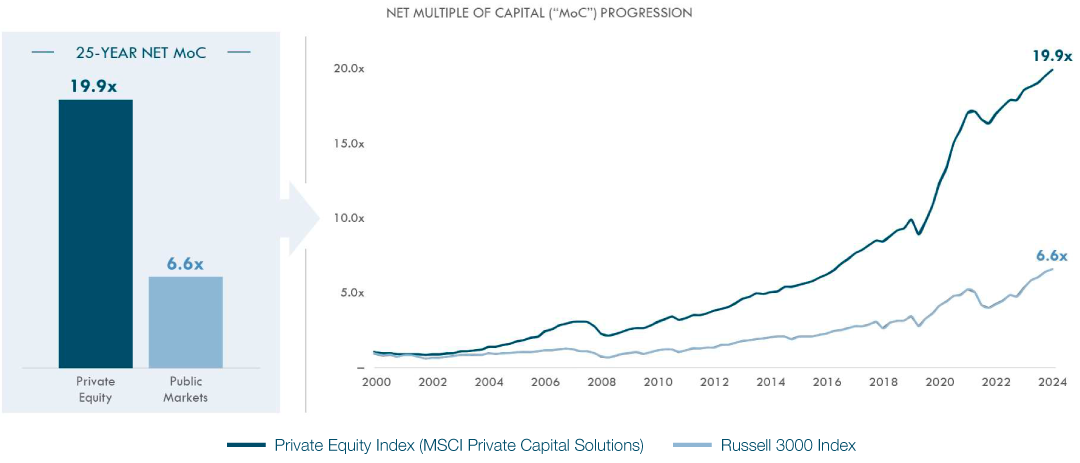

Fig1 : 25-years performance: private equity vs. public markets

Source: MSCI Private Capital Solutions / Bloomberg.

One of the earliest beneficiaries of private markets investment was Yale University. With the benefit of the very long-term outlook of an endowment, David Swensen, former Head of the Yale endowment fund and private markets pioneer, realised the power of commitment in driving returns. He actively avoided liquidity: in his view, lower returns were too high a price to pay for a patient investor. Over his 36 years at Yale, until his death in 2021, Swensen maintained a large exposure to private equity and grew the endowment from $1bn to $36bn with the performance of Yale’s endowment consistently generating returns over and above its rivals.

The private equity opportunity set

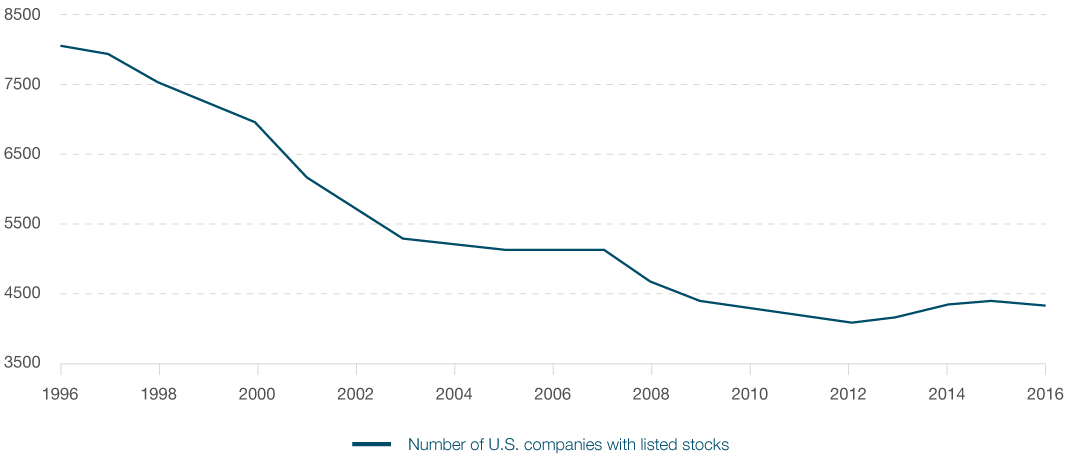

Another reason for private equity’s success is simply that they have a far larger “addressable universe”. There is a finite number of listed companies in which to invest, and this number has been slowly shrinking over decades. By contrast, the population of private companies is theoretically unbounded, and certainly growing, with more and more high-growth companies staying private for longer. It is the productive economy itself – ranging from family-owned companies and founder/entrepreneur-led businesses to neglected divisions of corporations, state-owned assets that could thrive as privately-run enterprises, and even private equity-backed companies that have outgrown their existing owners.

Fig2 : Number of U.S. companies with listed stocks

Bank data as of 10/29/2017.

In addition, more well-run businesses with ambitious management teams are proactively choosing private equity ownership. There is a growing preference among the best executives and entrepreneurs to partner with private investment firms that share their vision and growth mindset, and have the financial firepower and operational expertise to help accelerate their growth.

This is what makes private equity an opportunity-rich environment – and one that is best prosecuted with freedom and flexibility, delivered through an investment and incentive framework that closely aligns the long-term interests of managers and investors.

A lack of commitment leads to volatility

A lack of commitment in any relationship inevitably leads to volatility. Private equity performance is less volatile than public equities, not only because it is not bound by a rigid and frequent public reporting framework, but also because the companies are not held permanently for sale, at a moment’s notice. In other words, the longer-term nature of the commitment made by investors gives managers discretion over liquidity events (i.e. the timing of buying and selling companies). This makes the asset class less volatile at a fundamental level.

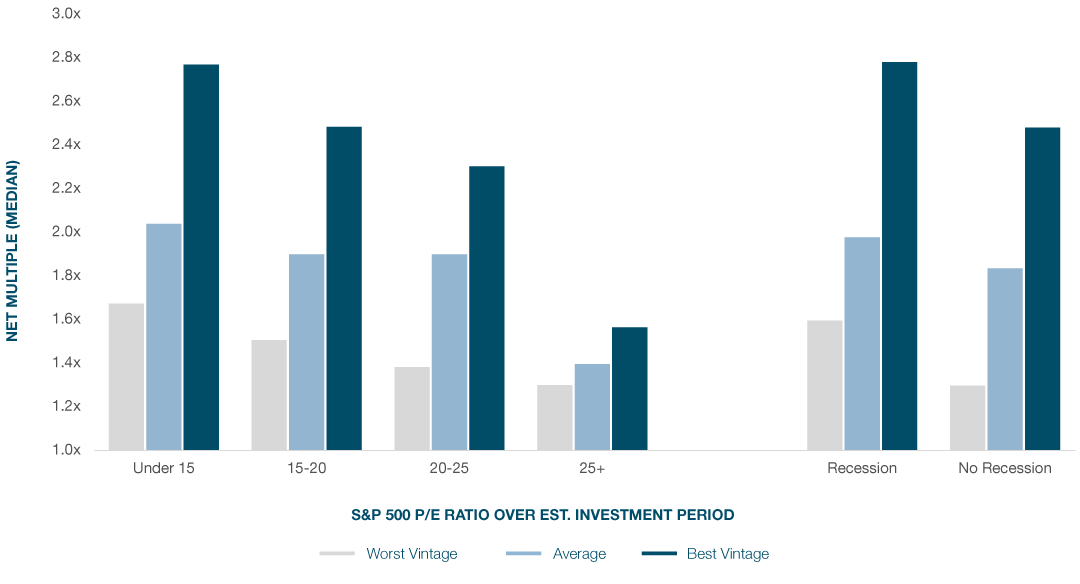

Manager discretion is also one of the reasons private equity tends to perform particularly well in downturns. Contrary to efficient markets theory, occasionally stock markets do have a tendency to overreact. This gives those with committed sources of capital and a long-term investment horizon, an opportunity to deploy capital in fundamentally attractive businesses at sensible entry multiples. In fact, history tells us that the best-performing private equity funds are often invested in times of volatility elsewhere.

Fig3 : Better vintages deploy in downturns

Source: S&P 500 Average P/E over Est. Investment Period represented by the average of the Price to Earnings Ratio of the SPX Index over years 0-3 of the vintage year, recession periods determined by USRINDEX Index, Preqin, Net Multiple (Median) by the Preqin Private Equity-All vintage year benchmark Median Net Multiple as of 7/31/2022.

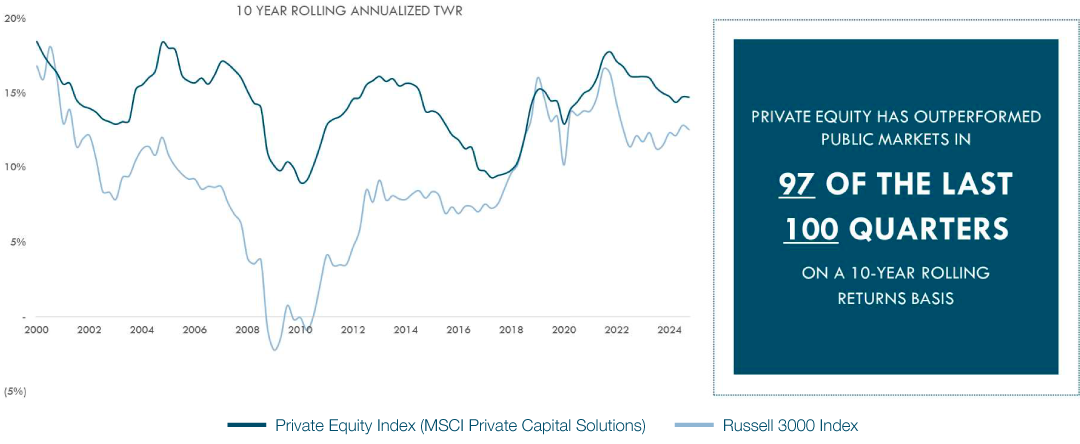

That’s why, over the major downturns and crises of the past few decades, private equity has overall performed better than listed markets. Over the past 25 years, private equity has outperformed public markets in 97 of the past 100 quarters, on a rolling return basis, as illustrated in Fig 4.

Fig 4: Public vs private equity performance: 10-year rolling annualised time-weighted return

Source: MSCI Private Capital Solutions / Bloomberg.

In private markets, risk and return is not a zero-sum equation because it is the domain of real commitment and investment, where companies have the time and managers have the freedom to build objective value, that lasts.

However, investors should be aware that not every deal and not every fund will outperform. Private equity ownership on its own isn’t a formula for success. You still need the right team and approach to deliver the best results. Each private equity manager will have their own approach to creating value and driving returns. We will look at some of the ways this is done in the next article.

This document is provided for informational purposes only and should not be construed as an offer, invitation, or general solicitation to buy or sell any investments or securities, provide investment advisory services or to engage in any other transaction.