Evelyn Partners attracted £5.4 billion of new business in 2022 and achieved record operating income

Evelyn Partners is pleased to announce a trading update for the three months ended 31 December 2022 which showed continued robust net inflows and strong growth in operating income.

Highlights

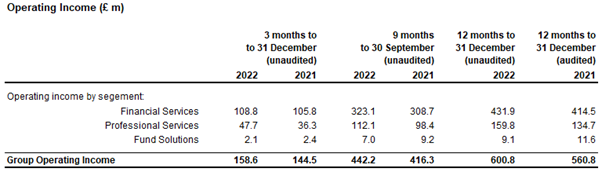

- Group operating income in Q4 of £158.6 million, up 9.8% from £144.5 million in the same period last year, driven by continued strong performance from both the Financial Services and Professional Services businesses.

- On a full-year basis, operating income for the year rose 7.1% to a record level of £600.8 million.

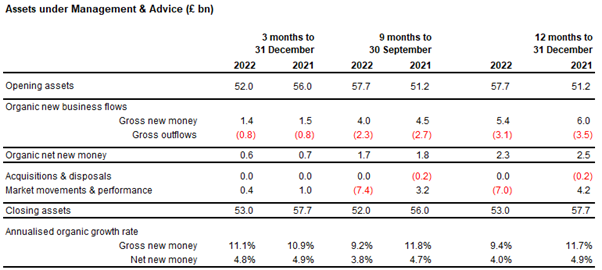

- Gross inflows in Q4 were £1.4 billion, representing an annualised growth rate of 11.1% on opening assets. Net inflows in Q4 were £625 million, equating to an annualised growth rate of 4.8%.

- Across the full-year, gross inflows were £5.4 billion and net inflows were £2.3 billion in 2022. The latter represented an annualised growth rate of 4.0% for the year, reflecting the strength of the Evelyn Partners proposition.

- Assets under Management & Advice (AuMA) were £53.0 billion at 31 December, up from £52.0 billion as at the end of Q3.

Chris Woodhouse, Group Chief Executive, commented:

“We ended 2022 with continuing strong new business inflows and growth in operating income in Q4. This rounded off a year of excellent delivery against our strategy, in which we saw £5.4 billion of gross new money won and operating income reach an all-time high of £600.8 million. Our strong performance, against a difficult market backdrop, is testament to the quality and breadth of our advice-led proposition and demonstrates the positive momentum in our Financial Services and Professional Services businesses.

“2022 was a year of considerable development for the business. We successfully executed the rebrand, which has been well-received. We made continued progress with our digital innovation agenda and have further enhanced our client proposition. The latter included the relaunch of Bestinvest as a hybrid service combining best-in-class digital tools with free coaching, low-cost advice and the launch of our new Smart fund range. Our Retiring IFA programme, which is designed to provide financial advisers who own their businesses with a long-term home for their clients ahead of their own retirement, also progressed well during the year, with six deals completed in 2022. This takes the total ‘RIFA’ deals completed to eight since launching the initiative at the end of 2021 and will support future inflows of AuMA.

“The performance announced today has been underpinned by the commitment of our people to delivering good advice, and the trust they build as partners to both private clients and businesses.

“The outlook for Evelyn Partners is very positive as we move into 2023, with our unrivalled combination of services well-positioned to take advantage of the opportunities ahead. Our strength in financial planning and both private client and business tax advice is particularly relevant given the rising tax burden in the UK.

“We are continuing to hire new talent and are further enhancing our services. Recent developments include the launch of four new Evelyn Multi-Asset funds that invest in direct equities and bonds alongside collective investments. We have also just launched a new app for Bestinvest and will shortly be adding the ability to trade US equities on the service. To complement this organic growth and progress, we also continue to explore opportunities to acquire high quality businesses in both the financial advice and professional services sectors where we see a strong strategic and cultural fit. I look forward to working with the team to maintain this momentum as we continue with our growth trajectory.”