When Permira invested in Sushiro in 2012, it was already Japan’s number one sushi restaurant chain, with more than 300 outlets, a celebrity CEO and a simple, proven formula for success. However, its growth was stalling. Permira believed there was consumer appetite for much more.

“Working in partnership with Sushiro’s entrepreneurial management team, Permira applied global best practices to roll-out a highly respected concept to many more consumers. The continued growth of Sushiro since its IPO is a testament to the strong operational foundations we laid.” - Alex Emery – Partner, Permira

Tasting success

When Sushiro crossed our radar, the business was run from a suburb of Osaka by an entrepreneurial CEO who had joined from college as a sous-chef in the 1990s. Latterly, the concept had been rolled out rapidly under previous ownership, but the expansion had slowed to a trickle, and there was a general belief that development opportunities had been largely exhausted. Throughout its history, Sushiro’s offering to consumers had not been meaningfully updated. We began our partnership in 2012, and immediately set about opening new ‘Kaiten’ conveyer-belt style stores, driving a strong financial return and refreshing the restaurants’ offering.

The price of rice (and fish)

Based on our analysis and experience of good retail practices from around the world, we convinced management to introduce a range of innovations, including:

- Expanding the menu range from its signature price-point of ‘2 pieces for ¥100’, with higher-priced items

- Investing in its procurement team to achieve better terms on ingredients

- Accepting credit-card payment (it was formerly ‘cash-only’ in a ‘no-frills’ quality commitment)

- Launching web-based a mobile reservation app that also enabled customer insight and analytics

In addition, we complemented the management team with senior consumer-facing executives, such as former Walmart Japan CEO, Steve Dacus and former Japan Airlines COO, Koichi Mizutomein a seamless leadership succession.

Sushi roll-out

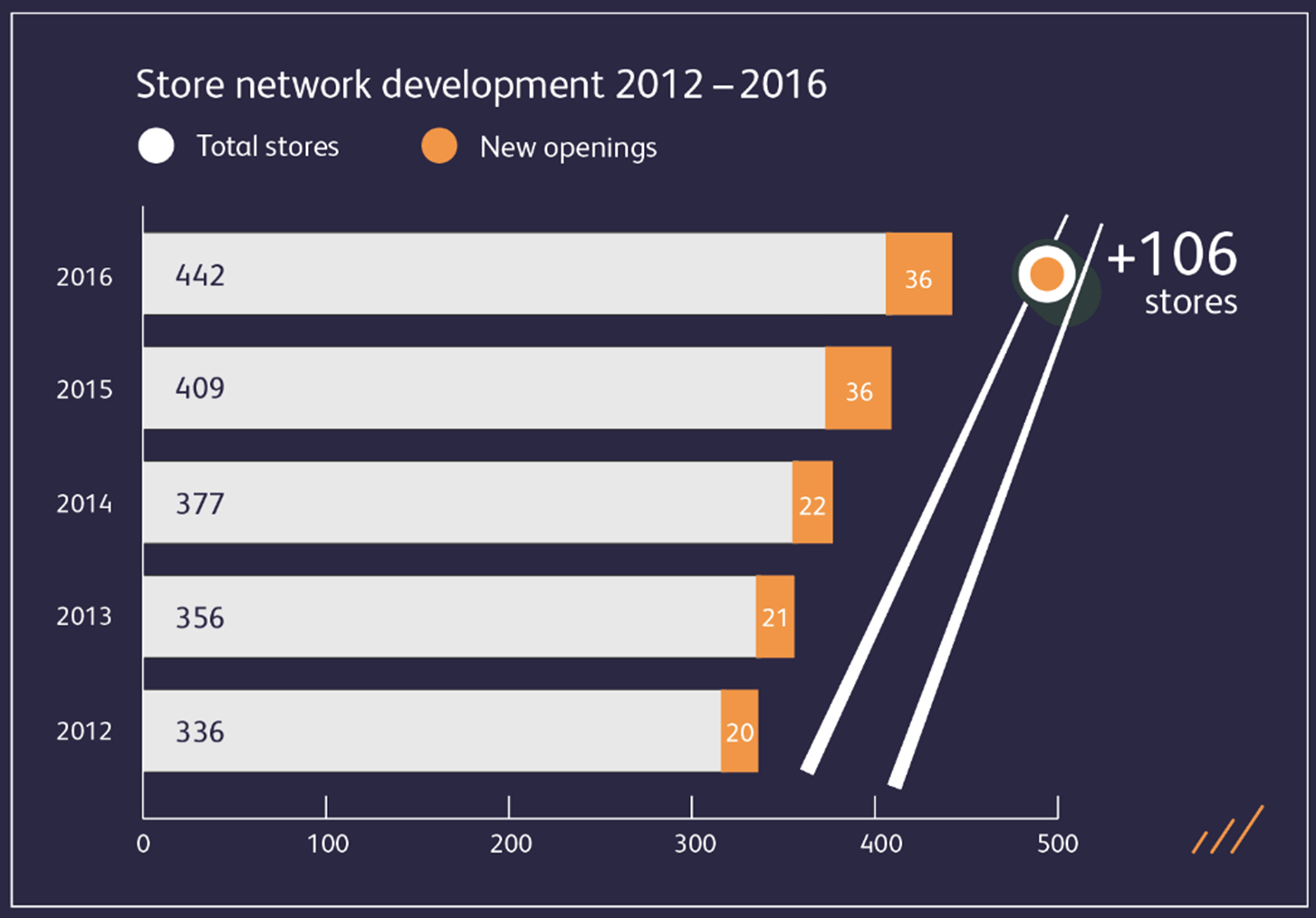

A district-by-district analysis had convinced us that there was great untapped potential for a much more rapid store roll-out, and that this could be underpinned by the success of operational improvements.

Sushiro’s management team executed a revamped and ambitious expansion programme, taking the brand into more competitive or complex catchment areas, including city centers. A well-resourced real estate team was introduced to support this effort.

As a result, the pace of new openings accelerated significantly, with outlets increasing from 336 to 442, while Sushiro’s market share grew from 20% to 24%.

A landmark IPO

Public flotations of private equity owned businesses were rare in 2017, but the strength of the business and the broad popularity of the brand across the country meant that, less than five years after the investment, Sushiro’s CEO rang the stock exchange bell. Permira sold a majority of its holding on IPO and exited completely within the year, providing fund investors with several times their original investment.

The IPO enjoyed high levels of retail participation and, in the several years since listing, Sushiro has experienced a rapid rate of growth.