The rise of cloud computing upended software pricing models as upfront licensing fees with annual maintenance charges were frequently replaced by subscription services. Today, another shift in software pricing is well under way and is being further accelerated due to advances in Generative AI. Software vendors are moving increasingly towards consumption or usage-based pricing (UBP) models.

The transition initially began with infrastructure software and cloud hyper-scalers, such as AWS and Microsoft Azure; then it spread to middleware providers, such as Plaid and Twilio; and finally, to applications, such as Zendesk and HubSpot. Today, more than half of SaaS companies have a UBP component to their revenue model which better aligns company revenue models with the value they are providing to their customers.

The emergence of Generative AI enables increased productivity for employees seemingly presenting another ideal opportunity to charge based on actual usage of the technology vs a traditional seat-based subscription. While it is still early days, leading companies like OpenAI are charging customers for API usage. Microsoft has taken a different approach with its AI Copilot offering, opting for a fixed $30 per user per month. While the simplicity is notable and early estimates point to swift adoption, this likely leaves money on the table long term as revenue will not increase with additional usage and may actually decrease if productivity gains result in fewer employees.

There are a number of attractions to UBP from both the vendor and customer perspectives. However, careful design is necessary to avoid common pitfalls.

For the customer, UBP aligns cost with value (only pay for what is used) and removes any friction to increase usage. The lower cost of trialling encourages existing customers to experiment with additional modules and use cases, which can then be scaled rapidly in proportion to their usage. Over time, this alignment and simplicity should lead to increased customer satisfaction and ideally more product usage.

The benefits of a UBP approach to vendors are clear when looking at various measures of growth and efficiency of publicly traded software companies. At a conceptual level, higher growth and net retention are enabled by a much easier upselling path: if a customer needs more, they can just use more – no need to change subscriptions or interface with an account executive. In addition, the lower initial cost makes software more accessible to smaller companies, increasing the size of the addressable market. Companies with a usage-based component also exhibit higher magic numbers, which is a measure of sales and marketing efficiency (higher is better) due to the lower selling effort required.

Given UBP can represent a win-win scenario for both vendors and customers, many leading companies are now offering such pay-as-you-use services, charging on a variety of consumption metrics.

However, there are also some potential drawbacks to usage-based pricing for customers. Decades ago in 1987, psychologists[1] found that consumers often exhibit a “flat-rate bias” – e.g., they prefer the certainty of a fixed monthly price to a per-minute telephone bill, even if it would be marginally cheaper. In 2006, researcher Anja Lambrecht christened that phenomenon the “taxi-meter effect”, whereby customers experience discomfort and value a service offering less if an extra minute or mile is costing them.

Furthermore, for vendors, UBP can introduce greater uncertainty as spikes in usage can lead to rapid revenue growth (or declines), and the resulting variability in customer invoices can cause a significant backlash impacting net promoter scores (NPS) or long-term net retention rates. In times of macroeconomic uncertainty, UBP may also result in a violent deceleration of revenue compared to subscriptions, which tend to be much more stable. The cloud hyper-scalers experienced this as their growth slow with difficult economic conditions around the world from rising inflation, the war in Ukraine and snarled supply chains impacted cloud usage and thereby revenue.

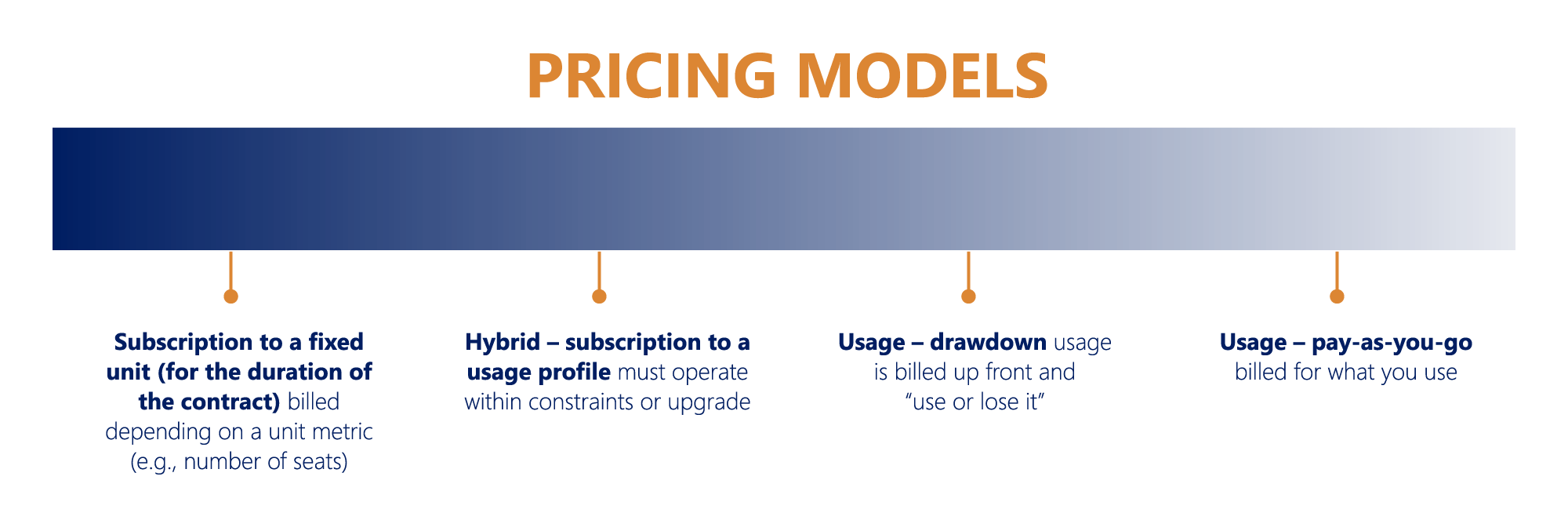

However, using a mix of different usage-based pricing models can help to maximize the benefits and limit the drawbacks.

Informatica, a US-based enterprise cloud data management leader backed by the Permira funds, offers multiple varieties of usage-based pricing from pay-as-you-go to its own version of usage drawdown pricing. Usage is based on units of consumption, called Informatica Processing Units (IPUs), and the usage drawdown model Informatica developed provides an interesting example of how usage-based pricing can be implemented with ingenuity to achieve the ‘best of both worlds’ for customers and Informatica.

Informatica has various data integration, application integration, data quality, governance, and cataloguing services that consume a pre-purchased set of IPUs at predetermined rates. Customers buy IPUs upfront in the context of known projects/use cases but receive access to the entire set of services on Informatica’s cloud data management platform. The customer then “spends” those IPUs based on their actual service consumption over the duration of a multi-year contract (typically two to three years). If customers need more IPUs to meet their expanding requirements, they can purchase more, but the minimum does not change if they consume fewer IPUs.

The beauty of this model is it aligns Informatica revenue directly with customer value as usage of their Data Management Cloud increases. This includes new workloads from growing data volumes and customer adoption of new Generative AI offerings (CLAIRE Copilot and GPT). While the IPU price curve offers a volume-price benefit, the additional volume outweighs the cheaper price point. The challenge that Informatica closely monitors is ensuring customers ramp up usage and remain engaged to avoid potential churn risk at the end of their contracts.

This pricing model has been rapidly embraced by customers, with over half of new cloud bookings being consumption-based and IPUs representing 43% of total cloud ARR. IPUs enable higher net revenue retention and allow for trialling new products and adopting new use cases. IPUs immediately expose customers to all the Informatica cloud products and provide the optimal path for an enterprise to standardize on Informatica’s data management platform. Importantly, Informatica’s usage drawdown model avoids unpredictable invoicing and revenue streams by spending significant effort upfront to appropriately size the fixed number of purchased IPUs.

The evolution of software pricing models has been a dynamic journey, and the rise of Generative AI is further accelerating the shift towards UBP. This transformation, initiated by infrastructure and cloud providers, has cascaded through middleware and application vendors, reshaping the software landscape and revenue models throughout. As software continues to deliver significant value to end customers, UBP is an effective way to align revenue to that value and ultimately have innovation leaders get paid for what they produce. As long-term, product-led investors, at Permira it is this alignment of value between vendors and customers that UBP provides which attracts us to businesses. We have seen time and again that software businesses with superior customer outcomes are one of the best leading indicators of future value creation potential.

[1] Daniel McFadden, Kenneth Train and Moshe Ben-Akiva