Evelyn Partners announces continued robust new business generation and strong progress on key strategic initiatives

Evelyn Partners, formerly known as Tilney Smith & Williamson, announces its interim financial results (unaudited) for the six months ended 30 June 2022. Against a challenging market backdrop, the business has continued to deliver strong growth in net new business and operating income, while also making excellent progress on key strategic initiatives.

Financial Highlights

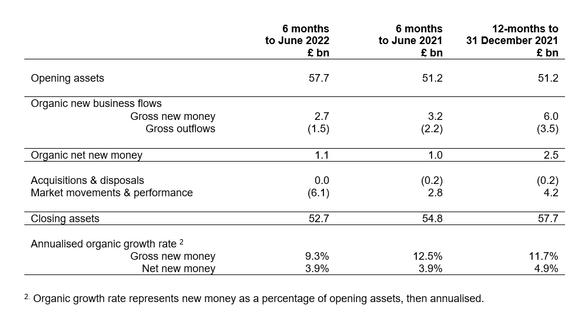

- Strong new business generation in Financial Services, with gross inflows of £2.7 billion, equivalent to 9.3% of opening assets on an annualised basis.

- Net new business flows of £1.1 billion were 12% higher than in H1 2021 and represented 3.9% of opening assets on an annualised basis.

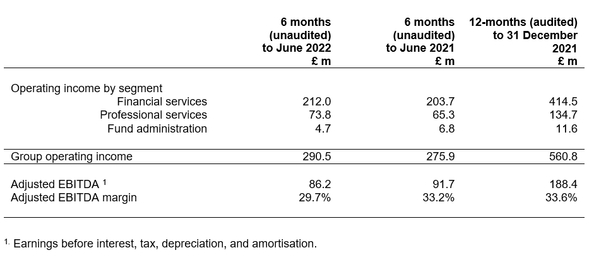

- Operating income increased 5.3% to £290.5 million (H1 2021: £275.9 million), with growth across both Financial Services and Professional Services.

- Assets under management decreased 8.7% to £52.7 billion at 30 June (31 December 2021: £57.7 billion) reflecting the impact of market declines.

Strategic Highlights

- Transitioned to the Evelyn Partners brand in June, which has been well received by employees and clients.

- Relaunched Bestinvest as a highly differentiated hybrid service, combining powerful online tools with support from investment coaches and the ability to purchase competitive advice packages.

- Continued momentum in our strategy of attracting financial advisers who have owned their businesses and are looking to retire. Teams from three firms have joined us year-to-date and there is a strong pipeline of further opportunities.

- Launch of Ignite, our Professional Services technology platform. This will drive further productivity enhancements and operating leverage as part of our wider digitalisation programme.

- Completed office relocations to 45 Gresham Street in London, and 103 Colmore Row in Birmingham, both of which are rated ‘Excellent’ under BREEAM, the world’s leading sustainability assessment method for buildings.

Chris Woodhouse, Group Chief Executive, commented:

“The war in Ukraine, high levels of inflation and rising borrowing costs have created a challenging backdrop this year, with both equity and bond markets down during the first six months of 2022. During this period our relative investment performance has been strong compared to peers.

“Despite this tough market environment, we continued to generate significant new business, with £2.7 billion of gross inflows and net flows of £1.1 billion, which were up 12% compared to the first half of last year. This growth is a testament to the strength of our proposition, the breadth and reach of our distribution, and the quality of our people.

“Operating income increased by 5.3%, with growth in both Financial Services and Professional Services. Adjusted EBITDA of £86.2 million was down 6.0% compared to the same period last year, reflecting a combination of increased costs as we have invested in the business to capitalise on the significant longer-term growth opportunity available to us and the impact of market declines on the fees that we earn from managing client assets. Going forward, our EBITDA will benefit from the annualised impact of both growth and efficiency initiatives implemented in 2021 as well as the migration of assets to our new platform during the second half of 2022 and in early 2023 which will generate material cost savings.

“A number of significant projects came to fruition in the first half of 2022, demonstrating continued progress against our strategy. These include the move to our new, unified brand in June, which enables us to present both existing and potential clients with our combined and wider service proposition. This has been accompanied by a promotional campaign around the theme ‘the Power of Good Advice’ to raise awareness of the new brand and to highlight that the best advice is often personal.

“Another milestone for the business in the past quarter has been the transformational relaunch of Bestinvest as a hybrid service combining the best of digital tools with investment coaching by qualified professionals. This enhanced and distinctive offering is well placed to help the estimated 9 million individuals in the UK who already have some form of long-term savings but who are not receiving professional advice and don’t know from where to seek it. This enhancement in our proposition means we can provide best in class capabilities to clients through the channel of their choice, whether digital, hybrid, or face-to-face.

“The macroeconomic environment looks set to remain challenging in the near term. However, it is during periods such as these that the value of sound financial advice and the need for a well-managed investment strategy become ever more apparent. Client engagement activity is high, and will remain so, as we help our clients navigate this period of uncertainty.

“Our unique breadth of services spanning D2C platform, financial planning, discretionary investment management, specialist tax advice and professional services, creates a strong competitive advantage. Given the strength of our business model, the unrivalled breadth of our proposition and the quality of our people we are confident in the prospects for Evelyn Partners despite near-term headwinds.”

Summary of H1 2022 Key Financial Measures

Assets under Management & Advice